Oct 2020: Government Support For Small Businesses Affected By COVID-19

This post is aimed at our clients - small business owners and employers.

Coronavirus Job Retention Scheme (CJRS) aka Furlough Scheme

Updated 12 Nov 2020

The furlough scheme has been extended to early 2021 to support businesses during the country's second national lockdown.

Between 01 November 2020 and 31 January 2021, employers can pay furlough to employees and claim this back from HMRC. The furlough scheme will continue through to 31 March 2021, but contribution rates will probably change from 01 February 2021.

Here's what you need to know.

About employee eligibility:

- Employees must have been included on a pay run that was submitted to HMRC by 23:59 on 30 October 2020.

- Employees that have been let go can be rehired and furloughed. They would need to have been employed on 23 September 2020. HMRC will know they were employed on this date if the employee was included on the last payroll before 23 September 2020 - and also on the next payroll after 23 September 2020. It is based on RTI submission dates, which normally ties in with the payslip date.

- Directors are treated like employees. A director on payroll is eligible for the furlough scheme.

About furlough pay:

- All employees earn furlough at 80% of gross pay based on a specific period of time.

- For employees that were eligible for the old furlough scheme - furlough pay is based on the old furlough scheme (i.e. bad news for anyone with higher earnings). This is the case even if a claim was not made for this person in previous versions of the scheme.

- For newly eligible employees on fixed pay - furlough pay is 80% of their pay in the last pay period on or before 30 October 2020.

- For newly eligible employees on variable pay - furlough pay is average pay between 06 April 2020 (or start date) up to their last pay period on or before the date they are furloughed.

- You can still flexibly furlough employees. An employee may work less hours than normal, and you may claim/pay furlough to make up for unworked hours.

About the cost of furlough:

- You will cover the cost of employers national insurance and employers pension contributions. Employers national insurance is 13.8% on gross pay in excess of £732 per month. For example, if an employee earns £1,000 in December, employers national insurance is (£1,000-£732) x 13.8% = £36.98.

- You may choose to top-up earnings to 100% of normal pay, but it is not mandatory.

About agreements and contracts (I'm not a lawyer though!):

- You must agree furlough or flexible furlough by 13 November for furlough periods beginning 01 November.

- After this, you should agree furlough periods in advance.

- Flexible furlough agreements do not need to be specific about the exact hours that are to be worked.

- ACAS have a created a useful set of furlough templates.

And a few other important changes:

- HMRC will publish a list of all employers that claim furlough from 01 November 2020. This is to reduce fraud.

- Claims must be sent to HMRC by the 14th of the following month.

- The £1,000 Job Retention Bonus has been scrapped.

Job Support Scheme (JSS)

The Job Support Scheme is designed to help businesses that are viable but need help to pay employees. It was due to kick in from 01 November 2020 but will now commence in 2021.

There are two schemes - an open version for everyone and a closed version for businesses that are legally required to close as a result of local lockdown restrictions.

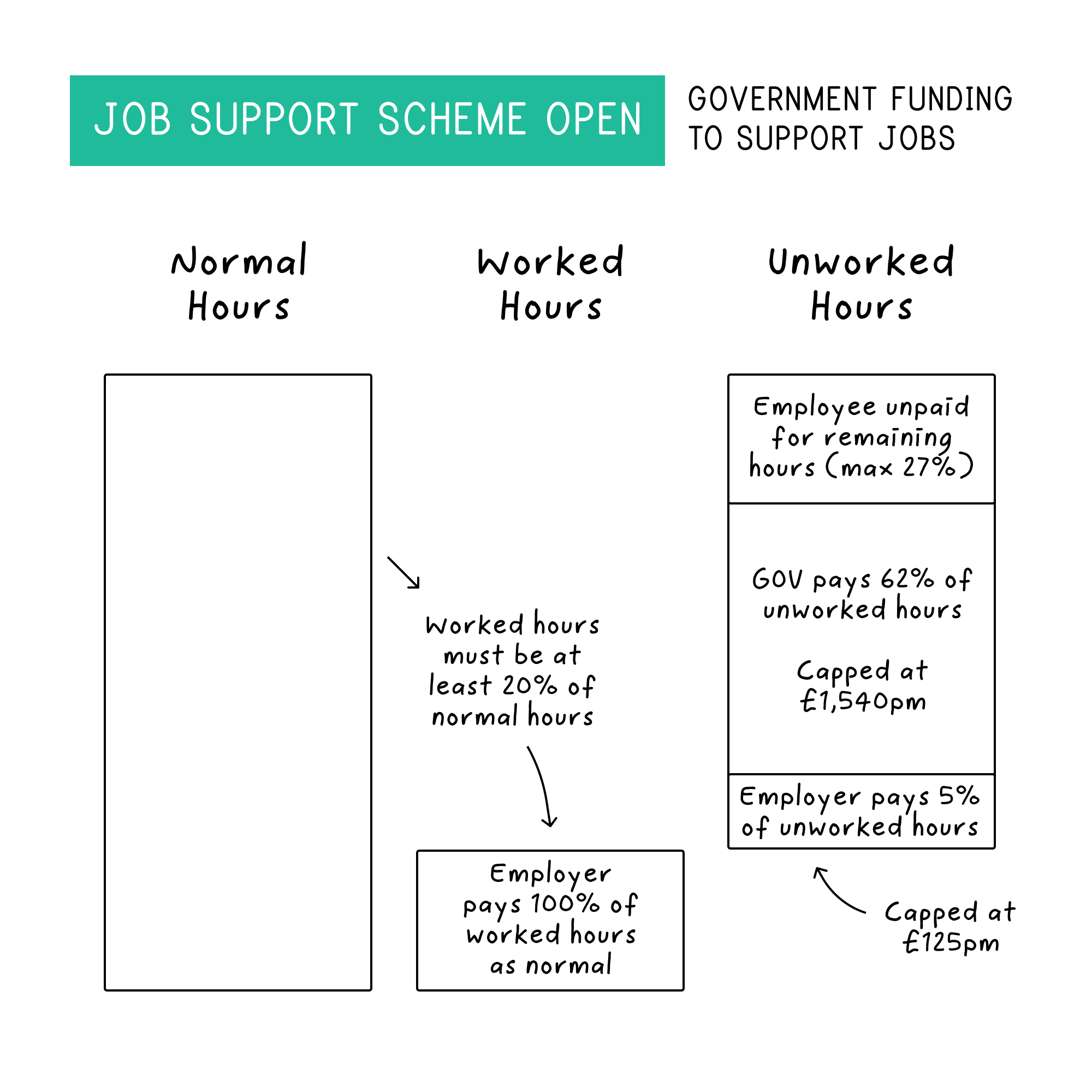

Job Support Scheme Open

The Job Support Scheme Open applies to employees that are working fewer hours than normal.

The government will contribute 61.67% of unworked pay, but only if the employer:

- pays the employee at least 20% of salary for hours worked, and

- contributes 5% of unworked hours up to a cap of £125 per month

Employers will still be liable for national insurance and pension contributions.

All small/medium businesses as well as some large employers will be eligible. You do not need to have claimed under the furlough scheme.

Employees included on your payroll submissions by 23 September 2020 are eligible for the scheme. Be aware that most monthly September 2020 payrolls will have been submitted after this date. Employees can cycle on and off the scheme, with a minimum period of one week.

Claims are capped at £1,541.75 per employee per month.

While details are still to be released, it seems likely that directors will be able to claim if they are working reduced hours.

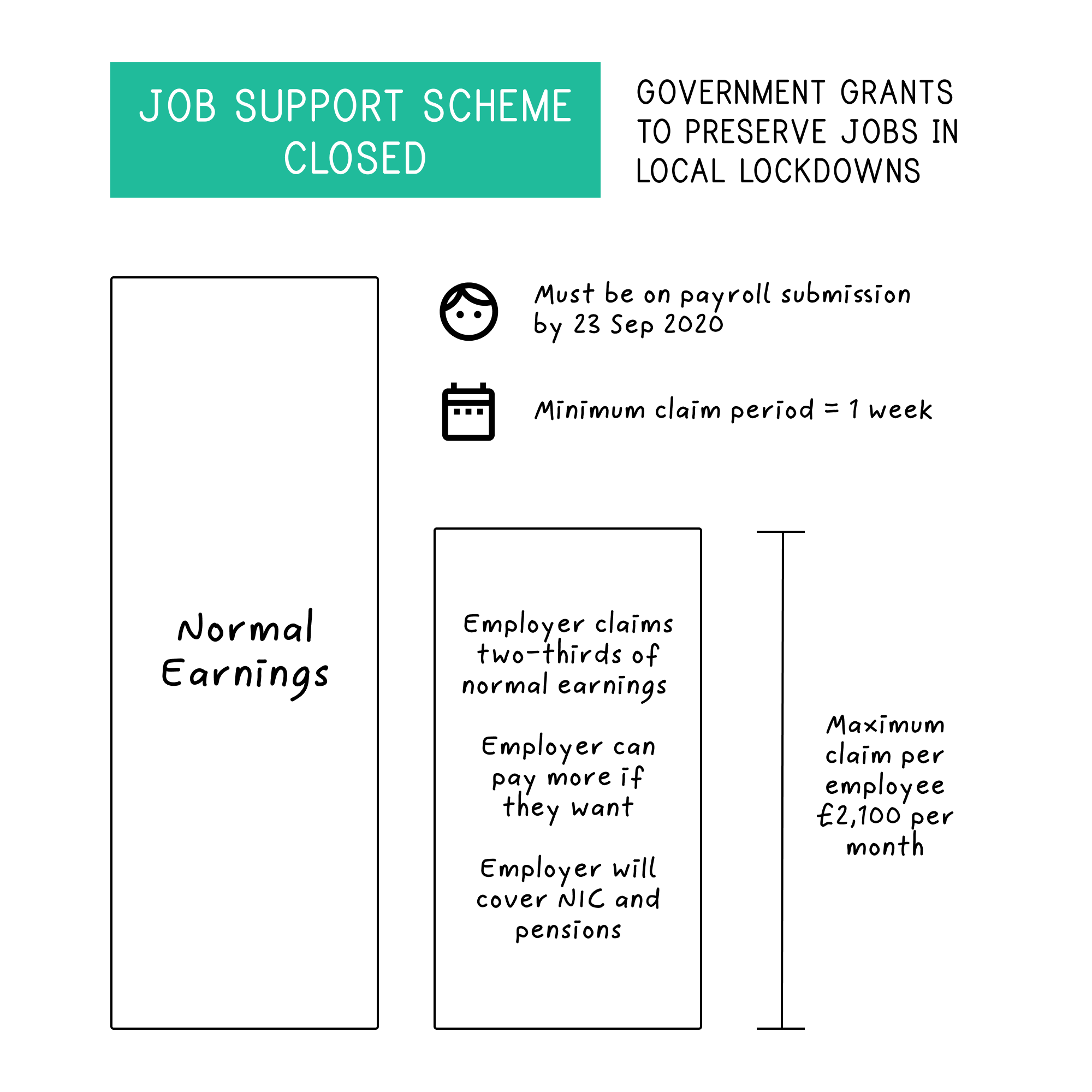

Job Support Scheme Closed

The Job Support Scheme Closed was created to better support businesses that are legally closed due to local lockdown restrictions. The expansion applies to businesses in England only, whereas the JSS Open applies to the whole of the UK.

Employers will be able to claim two-thirds of each employee’s salary. Claims are capped at £2,100 per employee per month.

Employers will still need to pay national insurance and pension contributions.

Employees must have been forced out of work for at least seven consecutive days. Their eligibility mirrors the main Job Support Scheme - details above.

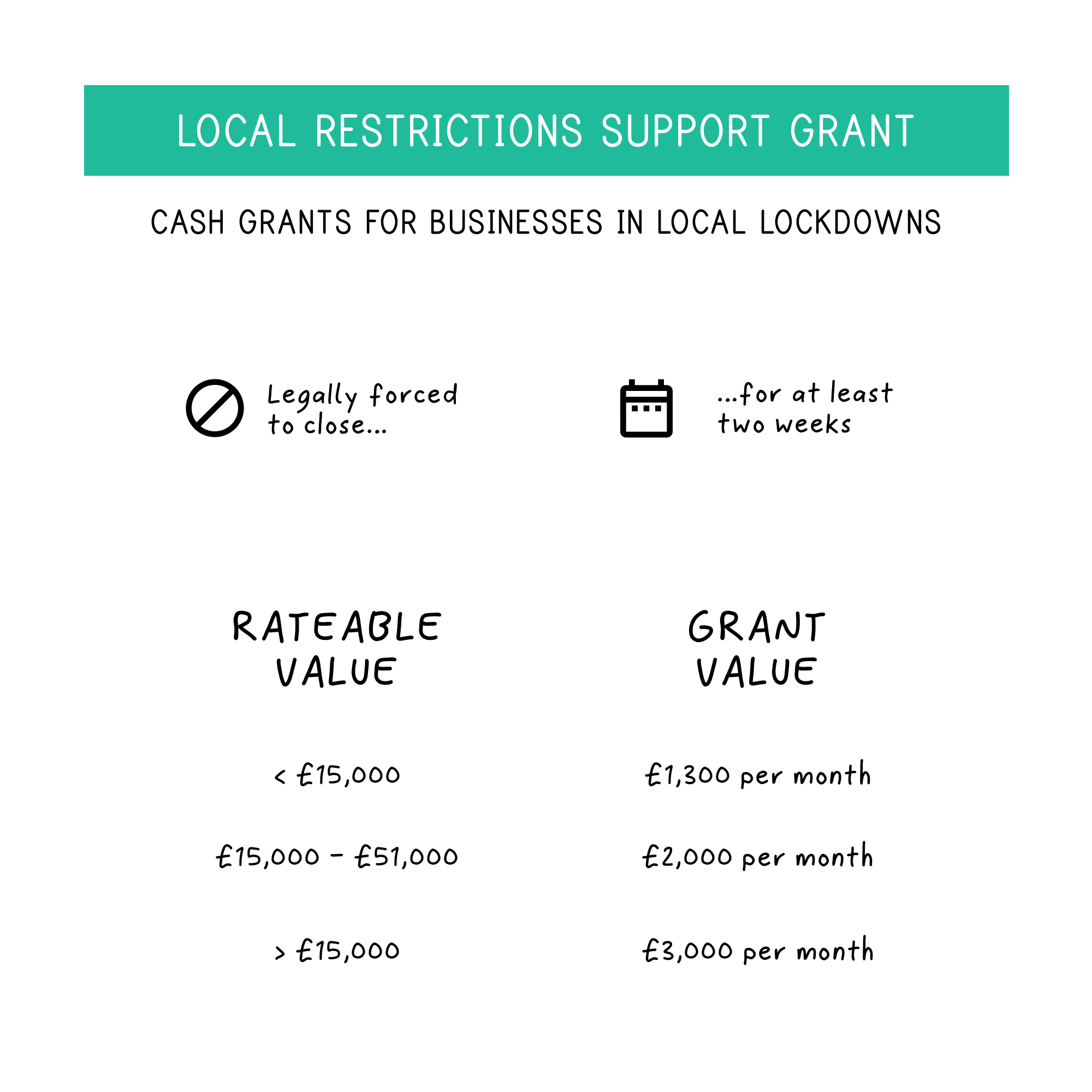

Local Restrictions Support Grant

Cash grants will also be payable to businesses with premises in England that are forced to close due to local or national lockdowns.

Grants will be linked to rateable value. The maximum grant is £3,000 per month, and you can only claim if you've been forced to close for at least two weeks.

You can apply on your local council’s website.

Kickstart Scheme

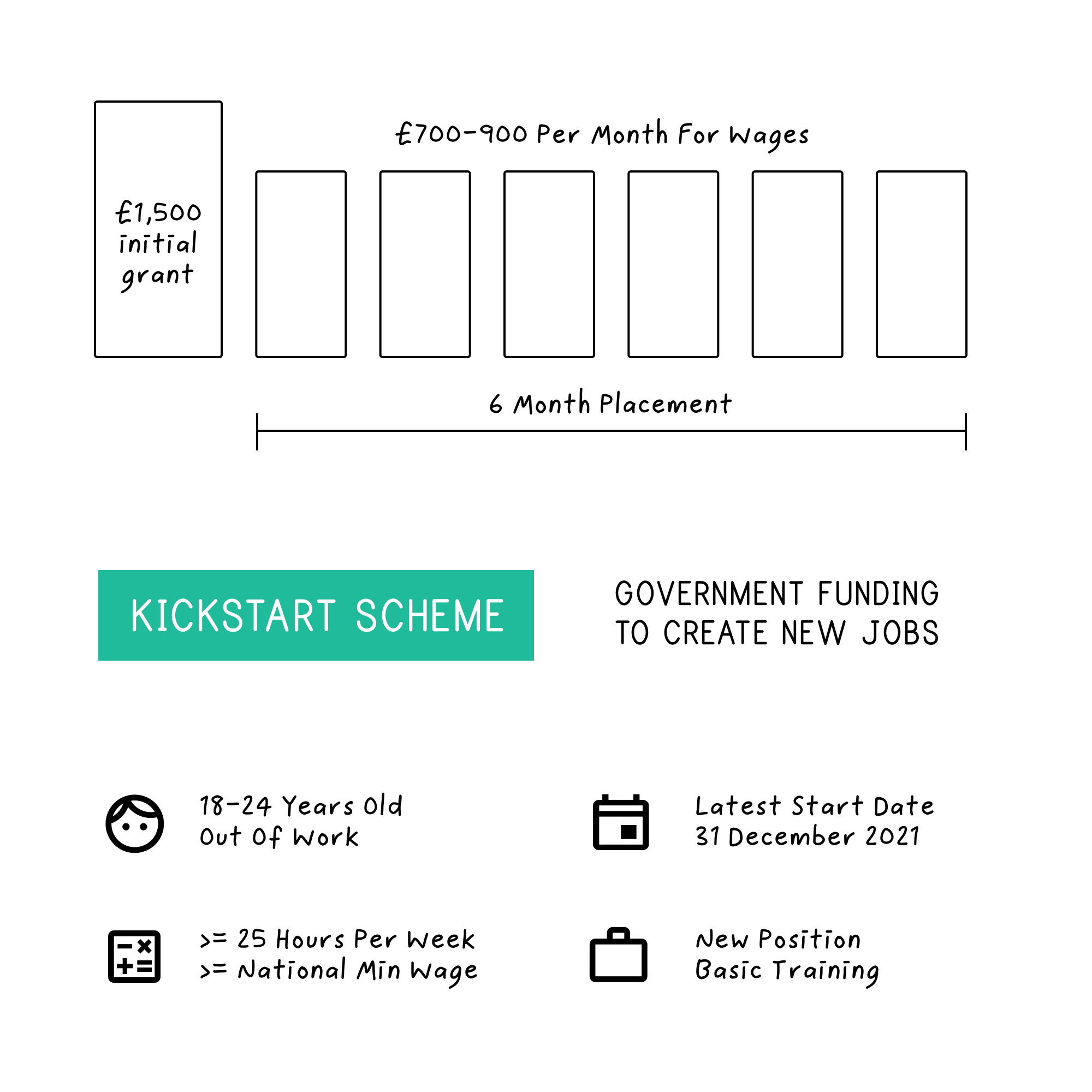

Did you know you can hire a young out-of-work person and the government will reimburse you for 25 hours of their wages at the National Minimum Wage for six months? This grant is worth £4,192-£5,330 in salary and you'll also receive £1,500 to cover setup and training costs.

The Kickstart Scheme has flown under the radar - it was initially limited to employers that can offer at least 30 new job placements, which ruled out small businesses.

But it is possible to combine your application with other businesses to make up the numbers, opening the scheme up to every employer. The government have even created a directory of 'gateway' advisors that will combine multiple bids and submit your application to the scheme.

However, there are several requirements.

The job must be a new position in your business, and cannot be used to replace an existing or outgoing employee. The new role must be for at least 25 hours per week and the new employee must be 18-24 years old and currently on Universal Credit.

You can pay more than National Minimum Wage, and you can employ the young person for more than 25 hours per week, but the grant is limited by these two factors.

Each job is actually a six month placement. After six months, you can keep the employee on payroll at your own cost. Or you can roll over the placement, hire another out of work 18-24 year old, and continue to claim 25 hours of weekly wages.

You'll also have certain responsibilities to ensure the young person has the right training and support to be able to look for employment at the end of the placement. Jobs must start before 31 December 2021.

We've already reached out to several advisors to discuss the scheme. We found that some advisors will support your application for free (mostly local authorities and charities). Others are quoting fees of around £150-£300 per placement, though the fee typically comes with additional support.

Here are three examples. You can find contact details on the government's directory.

WorkAdvisor - expect to charge £150-£300+VAT per placement for set up costs. WorkAdvisor are a recruitment firm so they are also offering to list roles on major job boards for £249+VAT.

Creative & Cultural Skills (listed as Creative and Cultural Industries Ltd) - are currently not charging for bids but may charge for additional support packages.

London Borough of Hammersmith and Fulham - do not charge for bids either. They have also partnered with WorkZone to provide additional support for free if you top up salaries to the London Living Wage of £10.75 per hour.

Job Retention Bonus

Unfortunately, the Job Retention Bonus was scrapped when extending the furlough scheme from 01 November 2020.

The bonus was set to be £1,000 for every employee retained from November 2020 to January 2021.

Coronavirus Job Retention Scheme - Overclaims

The original furlough scheme came to an end on 31 October and if you’ve claimed too much through the scheme, you can repay HMRC without incurring penalties or interest.

The deadline is 20 October 2020 or 90 days after you received the money, whichever is later.

Repayments can be offset against your final claim in October, or manually transferred back to HMRC.

HMRC continue to review and query claims, and may charge penalties if they uncover an error before you do.

VAT on Hospitality and Tourism

The new reduced 5% VAT rate for hospitality and tourism has been extended to 31 March 2021 (previously 15 January 2021).

VAT Deferral New Payment Scheme

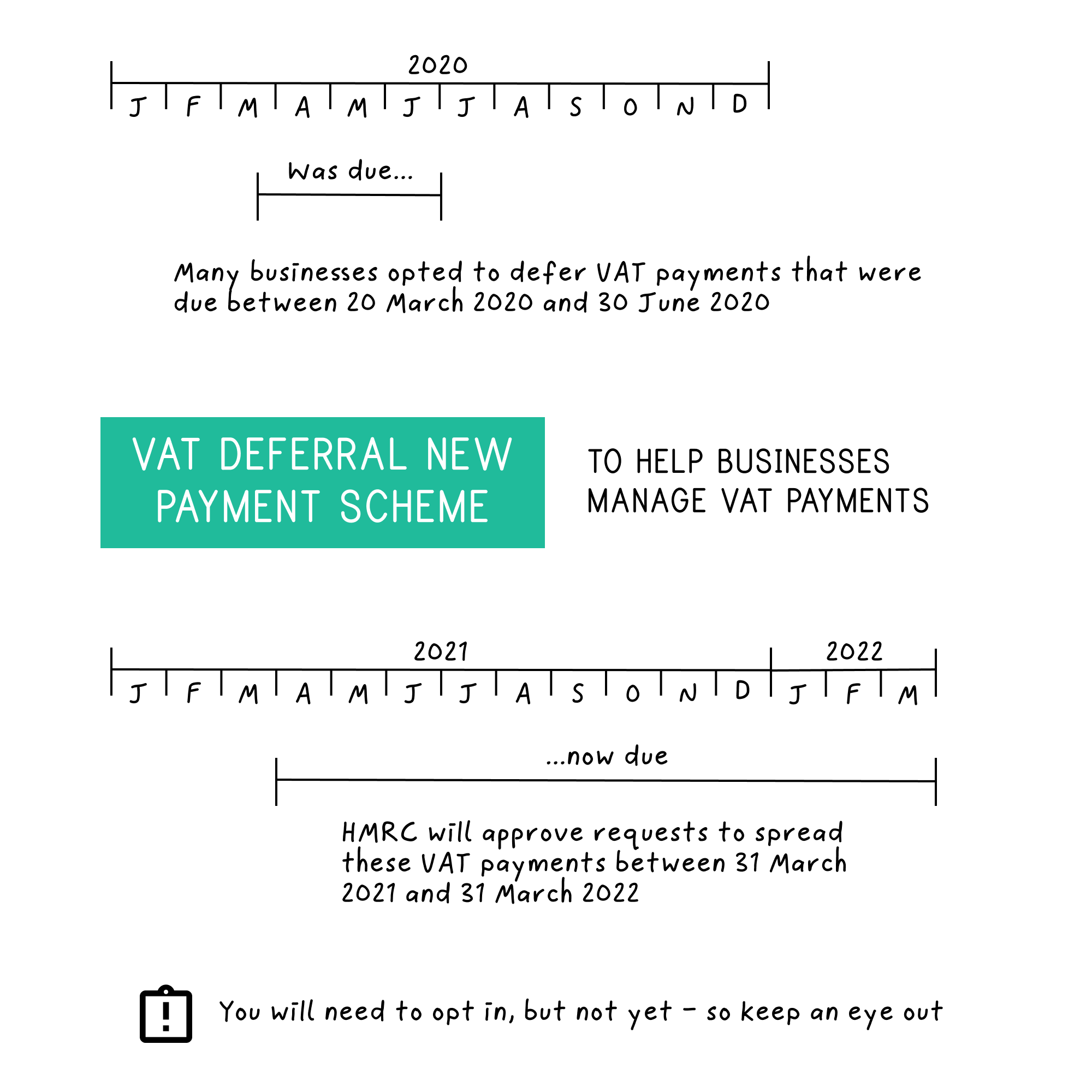

Many businesses opted to defer VAT payments which were due between 20 March 2020 and 30 June 2020.

The VAT remains payable by 31 March 2021, but HMRC have created an automatic payment plan if you need more time to pay.

The VAT Deferral New Payment Scheme allows you to spread your VAT liability over instalments from 31 March 2021 to 31 March 2022. You'll need to opt in closer to the due date.

You can still contact HMRC to set up tailored Time To Pay arrangements.

New Self Assessment Self-Serve Time To Pay Scheme

This scheme applies to anyone who usually pays income tax through self assessment, including business owners that regularly declare dividends.

Self assessment tax payments on account which would have due on 31 July 2020 were automatically deferred to 31 January 2021.

This means there are three self assessment tax payments due on 31 January 2021:

- Second payment on account for 2020/21

- Balancing payment for 2020/21

- First payment on account for 2021/22

If you owe less than £30,000 combined, you will be able to set up an automated Time To Pay payment plan online - without needing to call HMRC - to spread your liability over 12 months.

COVID-19 Recovery Grants

The government have allocated £20 million to Growth Hubs to support local businesses. Small businesses financially affected by the coronavirus can claim up to £5,000 to aid their recovery.

London-based businesses can apply for the grant at the London Business Hub. Applications open on 16th October and are reviewed on a first-come, first-served basis.

The grant must be used to assist with COVID-19 recovery plans rather than business-as-usual expenses, and there are several other requirements.

How To Claim

Financial support is available for small businesses affected by the pandemic, but this is spread across several schemes - each with their own set of requirements.

Send us a message if you need a hand understanding how these schemes can help you.