Hair Salon and Barbers: Small Business Accounting Guide (2021/22)

Introduction

If you're looking to learn more about:

- Employing staff, self-employment vs payroll, holiday pay, and paying tips

- Hair salon business expenses

- VAT for hairdressers

- Accounting software for hair salons

Then you're in the right place.

What to do when hiring hair salon staff for the first time

There are several essential steps you need to take when hiring stylists for the first time.

All employees must earn at least the national minimum wage, while many employers also opt to pay the real living wage too.

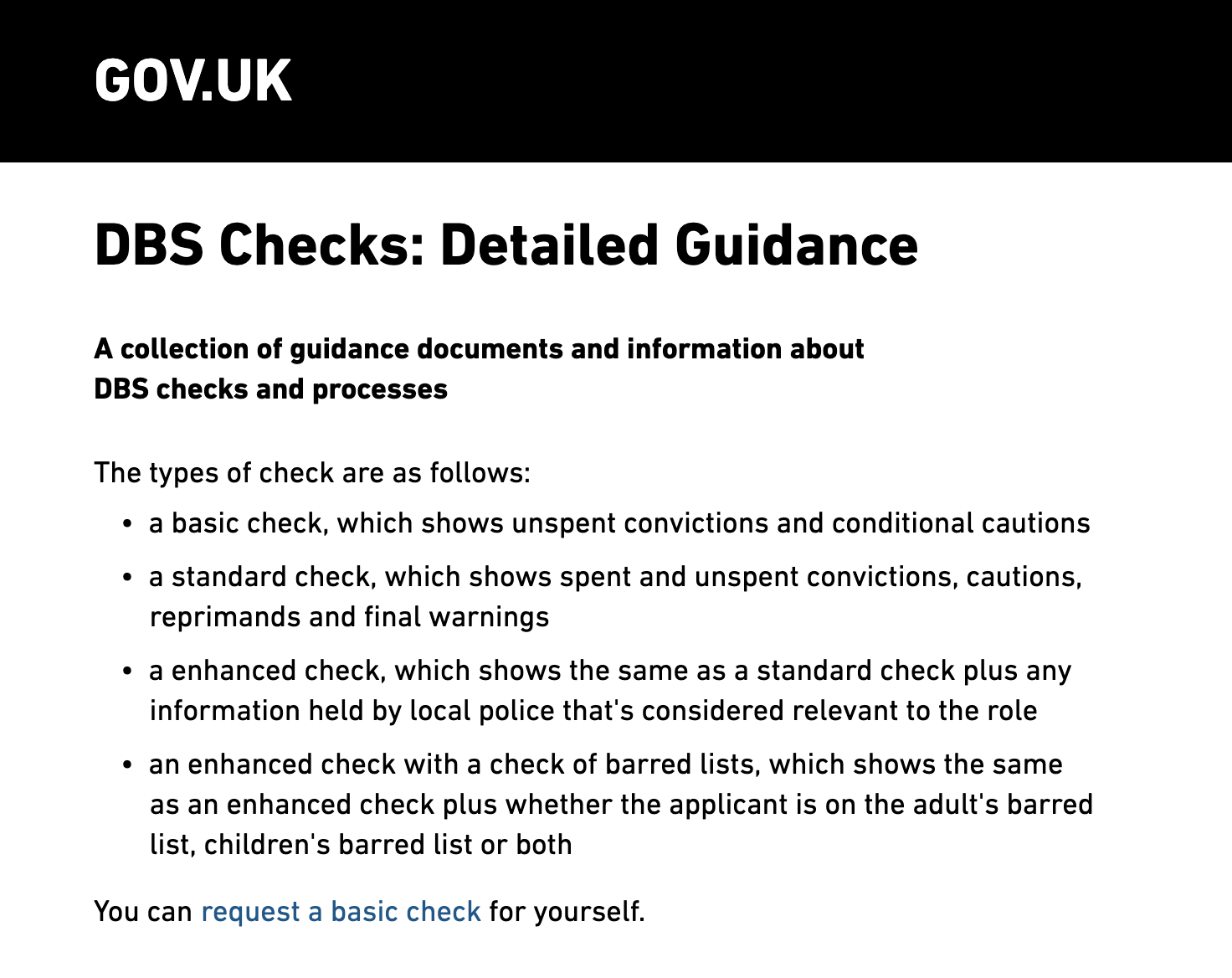

It’s important to check your employees have the right to work in the UK and you should also run a DBS check if they are going to work with children or vulnerable people.

Employment insurance is a legal requirement along with providing employees with a written statement of employment - or better yet - a simple employment contract.

You’ll also need to register an employee with HMRC and set up a workplace pension scheme. We recommend NEST or Aviva if you're just starting out.

If you’re looking for some help with holiday pay or service charge we have some handy guides that explain everything you need to know and those links can be found below.

But here's a common scenario - what if a hairstylist asks to be self-employed?

Are your stylists self-employed or employees?

One question that often comes up is whether stylists are self-employed or employees. This is a relatively common scenario but does fall into a tricky area and we would recommend talking it over with an accountant. But here are the basics.

Essentially you've got two options - you can either hire your employees and pay them through payroll (PAYE) - or you can work with self-employed hairstylists.

There are operational differences, such as working hours and the provision of equipment, but we won't go into these in too much detail. Instead, let’s look at the accounting implications of both approaches.

The benefits of paying employees through payroll (PAYE)

Paying workers through payroll is safer, simpler, and you'll likely have more control.

The benefits of working with self-employed hair stylists

On the other hand, working with self-employed hairstylists is a little cheaper as you'll save about 5-10% compared to hiring someone through payroll. This difference comes down to employers' national insurance, which you won't have to pay if someone is self-employed.

Unsurprisingly, HMRC prefers businesses that pay more tax and you'll need to be sure that your worker meets certain requirements if they want to be self-employed.

So what are these requirements?

What you need to do if you work with self-employed hair stylists

Most of these requirements involve making sure that your stylists' working conditions match HMRC's definition of a self-employed worker. For example, an employee usually works fixed hours and working days. They typically earn a salary or hourly rate of pay and work within the style guidelines of the wider business.

Whereas a self-employed stylist has more control over their craft, incurs more financial risk, and has fewer connections with your business, which could potentially equate to less control for the business owner.

Here are some of the main differences between the two:

To summarise, if you’re looking to work with self-employed hairstylists, then you'll need to make sure that they meet more of the conditions for self-employment than employment. And for brownie points, you should also draw up an agreement that clearly outlines a self-employment relationship between you and the worker, so everything is perfectly clear for both parties moving forward.

Further guidelines

Luckily, the National Federation of Hairdressers has already agreed on a set of guidelines with HMRC and these give further detail regarding the relationship you'd expect to have with a self-employed hairstylist.

Keep it simple

When it comes to business, we think it’s important to always try and keep things simple. You'll have plenty to do, what with attracting customers, keeping staff happy and managing cash flow, so it’s worth streamlining and simplifying wherever possible.

If you can, pay all of your workers through payroll. It might cost you a few extra quid, but you'll save time for the more important stuff.

Allowable Expenses for Hair Salons and Barbers

Another question that frequently comes up concerning hair salons and barbers is allowable expenses. Simply put, more profit, more tax. More expenses, less profit, less tax.

Here are some of the most common expenses you'll claim:

- property costs including rent, rates, utilities and cleaners

- capital expenditure such as furniture, equipment and computers

- direct costs like hair products and disposable equipment

- staff costs including salaries, travel and some entertainment

- marketing expenses including your website, PR and advertising

- digital expenses including software and email hosting

- typical business expenses like the internet, insurance, accounting, legal fees, postage and stationery

There are often additional expenses that people forget about, such as:

- working from home allowances (for admin staff and owners)

- some medical expenses

- training costs

You can also claim expenses that helped you get your new business off the ground, such as:

- business planning expenses

- travel and research costs

But you must remember to keep your receipts. Another well-worn accounting saying for you, no receipts, no claims, less money. We’ve got a handy guide to storing receipts and again you can find the link below.

VAT for Hair Salons and Barbers

If you generate more than £85,000 in 12 months, you must register for VAT.

The downside of this is that you'll need to charge VAT on your services, but the upside is that you'll be able to claim VAT on your purchases and you'll also be able to claim some expenses from before the date you register for VAT.

Here’s where things get a little tricky and if you haven't hired an accountant by this stage, then you might want to give it some serious thought.

Three ways to operate VAT for hairdressers

There are three ways to operate VAT for hairdressers but these depend on the employment status of those cutting the hair.

If your stylists are employees then things are relatively straightforward and you'll have to charge VAT every time your business provides a service. Put simply - you'll charge VAT at 20% on a haircut.

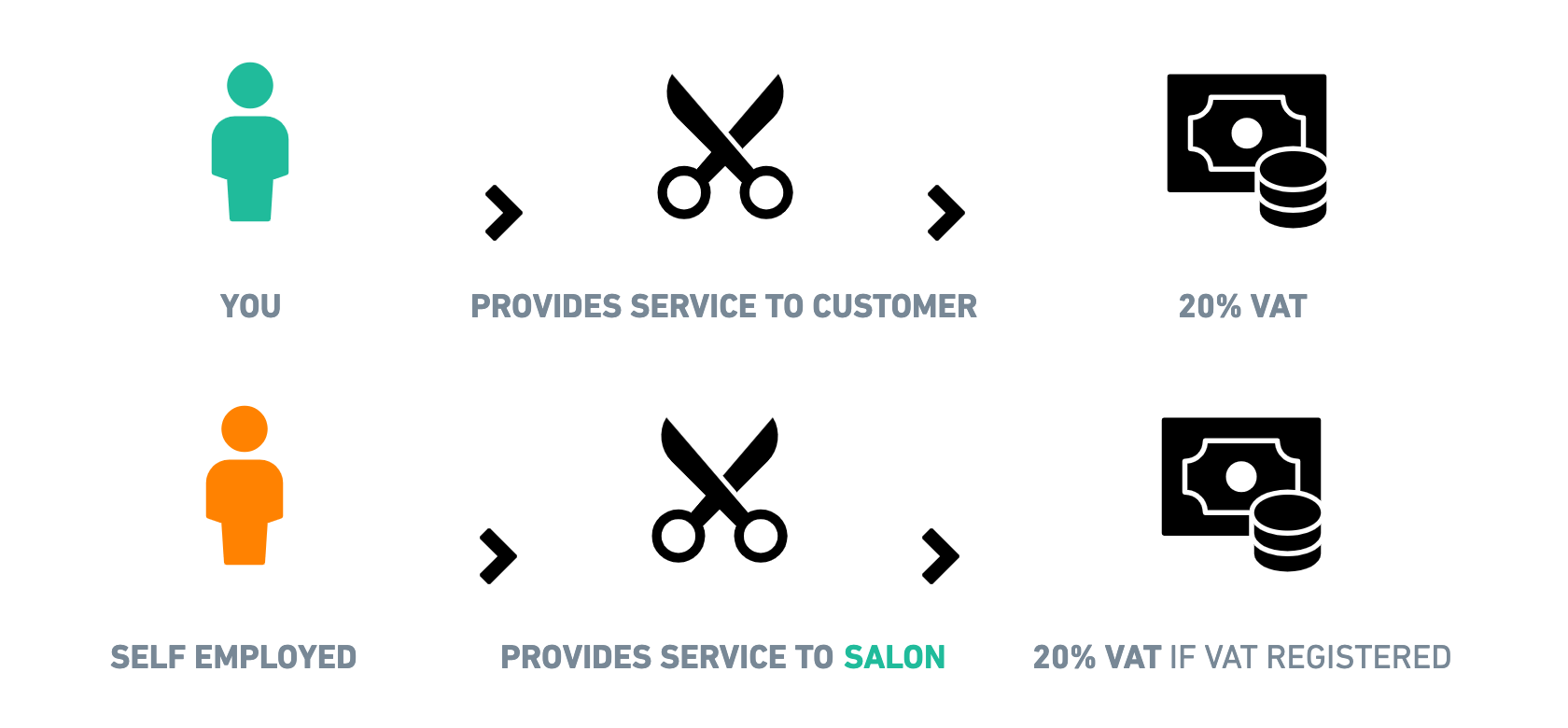

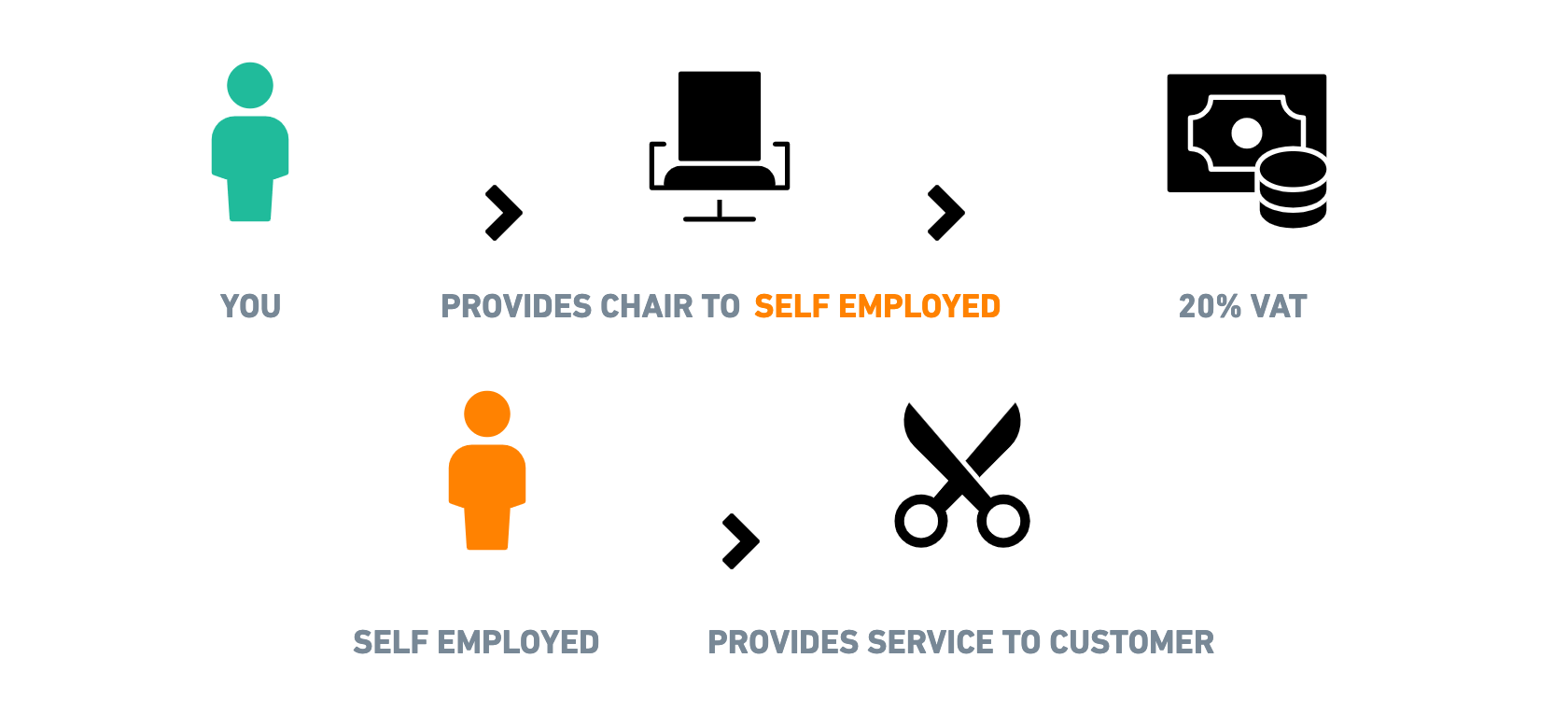

However, if your stylists are self-employed, you'll need to think about who is providing the service to the customer - and there are two ways this might work.

One option is that you provide the service to the customer and charge VAT, while your self-employed stylist provides hairdressing services to your salon. The stylist may charge VAT if they are VAT registered.

Alternatively, you provide a chair to your self-employed stylist and charge VAT, with the stylist providing hairdressing services to the customer.

While the first option, with the stylists as your employees, is certainly the most straightforward, the second and third options each pose a problem.

The second option is simpler to administer and probably what your customer expects, but harder to claim that such a stylist is self-employed because they have less financial risk.

The third option is a little trickier to administer, but the relationship looks more like self-employment, meaning it will be easier to make the case should HMRC ask any questions.

Hair Salon Accounting Software

And finally, accounting software. This is one area that often sends a shiver up the spine for many, but with the right kind of software, you really shouldn’t worry. You'll need two systems, one which tracks appointments and takes payments, such as Salon Iris, Lightspeed and Fresha, and another to keep receipts and track your finances.

We provide Xero and Dext to all of our hair salon clients and take care of integrating or transferring your sales data from your POS system to your accounting system.

Conclusion

So that's it for our guide to accounting for hair salons and barbers. Hopefully, we’ve cleared up a few of the complicated issues but feel free to reach out if you'd like to know more.

Get an instant online quote

We keep things simple with monthly plan fees, no minimum term, and unlimited tax advice.

Get in touch

Based in Wood Lane, we work with small businesses in London and the UK. Ask us anything.