Should You Charge UK VAT On Fiverr Gigs?

I run a UK business selling website design gigs on Fiverr. Do I need to charge VAT?

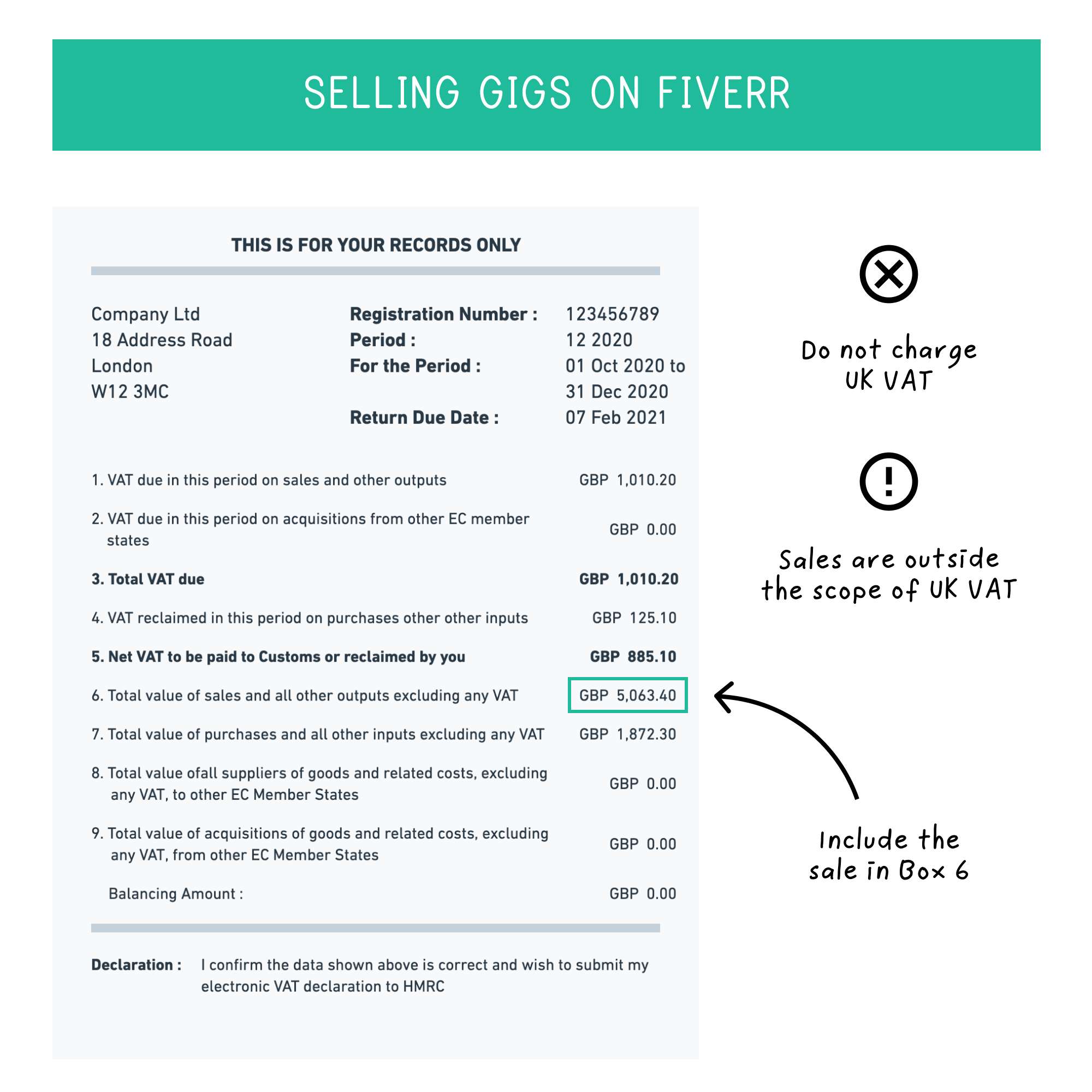

No, the sale is outside the scope for UK VAT. You do not charge VAT. The sale should be reported in box 6 of your VAT return.

Here's how it works.

As a VAT registered business in the UK, you need to consider two things when deciding to charge VAT.

- The type of product or service you are selling

- Where in the world the sale takes place, defined by the type of customer and their location

Website design is a digital service or electronically supplied service (e-service). HMRC's example list of digital services:

- radio and television broadcasting services

- telecommunications services

- electronically supplied services, including:

- supplies of images or text, such as photos, screensavers, e-books and other - digitised documents, for example, PDF files

- supplies of music, films and games, including games of chance and gambling games, and programmes on demand

- online magazines

- website supply or web hosting services

- distance maintenance of programmes and equipment

- supplies of software and software updates

- advertising space on a website

When you sell a product on a marketplace like Fiverr, it's not always obvious whether you are selling to the marketplace or the underlying customer.

HMRC clearly define the rules on marketplaces. The platform operator is supplying the consumer if they:

- identify you as the seller but set the terms and conditions, and

- authorise payment, delivery and download of the digital service

In this case, it's clear that Fiverr are selling to the customer - while you in turn are selling to Fiverr.

But should you charge VAT on the sale to Fiverr?

No. When you sell a service to a business, the sale takes place where the business resides. Fiverr are a business based in Israel, so you are supplying your service in Israel.

The service is outside the scope of VAT - meaning you do not charge VAT. However, you still need to include the total value of the sale on box 6 of your VAT return.

Want to talk through any of this?

I love hearing from business owners so feel free to get in touch.