Employing Hospitality Staff For The First Time in 2021/22

Hiring Employees For The First Time

Decide How Much You Want To Pay

National Minimum Wage

You must pay employees at least the National Minimum Wage (NMW), which is dependent on their age. You can view current NMW rates here. The government even publish a 'shame' list of companies that do not pay the minimum wage.

Market Wage Rates

London cafes and restaurants often pay staff and baristas between NMW and £13.00 per hour. The rate varies based on experience and seniority. We also find that salaries range from £18,500 to £30,000 per year. Chef salaries may range from £25,000 to £33,500. Check out jobs boards to find the market rate for similar companies in your area.

National Living Wage

Another option is to aim for the Living Wage. In 2020/21 the London Living Wage is £11.05 per hour and the UK Living Wage is £9.90 per hour. Can you commit to a meaningful wage for all employees? It may send a very positive message to your team and customers.

Check They Have The Right To Work In The UK

Employers forget to do this all the time. It's your responsibility to check that your employee has the legal right to work in the UK.

This simple tool will also help you to determine what documents you need to get from your employee.

Get Employment Insurance

Employers Liability (EL) insurance is mandatory. You need coverage of at least £5 million. You can be fined £2,500 per day if you are not insured.

The only exceptions are family members and employees based outside of the UK.

Write Up Employment Contracts

You must provide a written statement to employees. The government have outlined the type of clauses you must include in an employment contract.

It's risky, but you might decide to use an online template when getting started. And to be honest, we see this quite often in the small business space. But you should aim to write up a custom employment contract as soon as you can.

Register As An Employer With HMRC

Register Online

Your accountant can register you as an employer or you can complete the online form yourself. It's pretty easy to do, so don't let an agent charge you hundreds of pounds to complete it for you.

When To Register

You should register before you pay employees for the first time. The window for registration opens 28 days before your first payday. In practice, if you're a few days late, you're unlikely to get in trouble.

What Happens After You Register

HMRC will process your application and send you two payroll codes in the post. These are the Employer's PAYE Reference and Accounts Office Reference. You'll need these codes to send payroll data to HMRC - known as RTI submissions.

If you're experiencing delays, try calling the PAYE for Employers helpline.

Filing Requirements

Once registered, you'll need to send RTI submissions to HMRC. RTI submissions contain your payroll data for that period.

There are two types of RTI submission. Your choice of payroll frequency will determine when they are due:

- The Full Payment Submission (FPS) contains the bulk of your payroll data. You must send it on or before payday.

- The Employer Payment Summary (EPS) replaces the FPS if you do not pay anyone in the payroll period. It is also used to claim the Employment Allowance and statutory pay.

Choosing Payroll Frequency

Some cafes and restaurants run payroll fortnightly. This is good for employees as they get paid quicker, but it's a significant administrative burden. It's far better to operate monthly pay runs and reduce the time you spend on payroll duties.

Service Charge And Tips

This is a complex area that we discuss in more detail in our guide to income tax on tips and service charge.

Tips and service charge may be subject to income tax and national insurance so it's worth checking with an accountant. You might need to set up a separate payroll scheme, known as a tronc, to report tips.

However, tronc schemes sometimes lead to an unfair distribution of tips. You might find it fairer to pay employees a competitive wage instead.

Employment Allowance

The Employment Allowance is valuable for staff-intensive startups like cafes and restaurants.The first £4,000 of employers national insurance is free (2021/22). It's available for almost any business with more than one employee.

You claim it on an EPS at any point during the tax year. It’s been in place for a few years, but I still come across businesses that have failed to claim it.

Setup a Workplace Pension Scheme

Auto Enrolment

If you're employing staff, then you'll need to setup a workplace pension scheme and operate auto enrolment. This is the term given to mandatory pension schemes. They're not completely mandatory for employees - who can opt out if they want - but as an employer you must setup a pension scheme and give your employees the option to save for their retirement.

Pension Contributions

Broadly speaking, you'll pay 3% of an employee's salary as an employer contribution, and your employee will contribute 5%. The Pensions Regulator have outlines three methodologies based around this contribution structure.

Choosing a Pension Scheme

The choice of pension scheme is up to you - the employer. An employee cannot force you to pay into a different scheme of their choice.

I usually recommend three schemes to my clients:

AVIVA

The most expensive option for employers on my list but your employees will receive a pension scheme from a reputable pension administrator. You will need more than five employees to get started (the exact number varies). Aviva sometimes charge a monthly adminstration fee which makes it among the more expensive options for an employer.

B&CE

The People's Pension is backed by B&CE. A large workplace pension provider. It is less flexible and prestigious than Aviva but is slightly cheaper. The People's Pension charge a one-off fee to get started - £300+VAT (if you have an advisor) and £500+VAT (if you don't).

NEST

The government backed pension scheme. It was created to give employers a free option for their workplace pension. It is the most common pension scheme - over 90% of our clients use NEST - and a good place to start.

Employees are not stuck with your choice of pension for life. Pension pots are transferable between pension funds. You are also able to switch your pension administrator. So if in doubt - pick NEST - and you can change your mind later.

Pension Administration Fees

All pension providers levy an Annual Management Charge on your employee's pension pots. Some pension providers also charge a fee for setup or an ongoing administration fee.

Ongoing Payroll Duties

Monthly RTI Submissions

You will use payroll software to submit your monthly FPS. The FPS includes fixed data - like employee names and national insurance numbers, as well as monthly data like gross pay, income tax and national insurance contributions.

The EPS is not always required. If you do need to send an EPS, the deadline is the 19th of the following month. You will need to send an EPS to report blank payrolls, to claim the Employment Allowance, and to claim statutory pay.

Holiday Pay

Holiday pay can be a little tricky to understand - especially for irregularly paid staff.

Holiday Entitlement - Full Time Workers

Full time employees are entitled to 5.6 weeks of paid holiday per year. 5.6 weeks is equivalent to 28 days (ie 5.6 weeks x 5 days per week = 28 days). 28 days usually includes 8 bank holidays, so employees are entitled to 20 days holiday. You can offer more if you'd like.

In practice, ordinary full-time employees are usually granted 28 days of holiday. They are paid their usual monthly wage even when taking holiday leave. This meets the requirement for 5.6 weeks paid holiday leave outlined above.

Holiday Entitlement - Part Time Workers

Part-time employees are granted leave in proportion. Someone who works 3 days per week received 3/5 of the 28 day annual entitlement (ie 3 days / 5 days x 28 days = 16.8 days). Assuming the employee takes bank holidays off work, you might choose to grant them 9 days of discretionary leave per year plus 8 days off for bank holidays.

Partial holiday leave calculations are usually rounded up to the nearest half day.

Holiday Entitlement - Irregularly Paid or Casual Workers

Now onto the tricky part.

Many of your employees will work irregular hours. Calculate their holiday entitlement. For every hour of work, the employee accrues 7.242 minutes or 12.07%.

For example, if an employee works 64 hours (over any number of days):

- Holiday entitlement = 7.242 x 64 hours = 463.5 minutes or 7.7 hours

- Holiday entitlement = 12.07% x 64 hours = 7.7 hours

Employees accrue holiday entitlement over time, and you'll likely keep track of this using rota software. Workers will claim holiday leave at a time of their choosing, and in the next payroll you will include holiday pay at their usual hourly rate.

Hourly Rate For Holiday Pay

There is a chunky guide to calculating the average hourly rate for holiday pay, but you can keep it simple by paying an employee at their current hourly rate. This quick solution will fail if an employee's hourly rate of pay has fallen in the last 52 weeks of paid work, which is unusual, so you generally don't need to worry about it.

Holiday Leave At Year End

There are limits to the amount of holiday an employee can accumulate. An employee entitled to 28 days of holiday leave must be allowed to carry foward at least 8 days into the following year. It's a use-it-or-lose-most-of-it scenario. So encourage your employees to take holiday leave or holiday pay as as often as they can.

Employees also accrue holiday while on statutory leave - like maternity/paternity leave - which can build up to a significant number of hours.

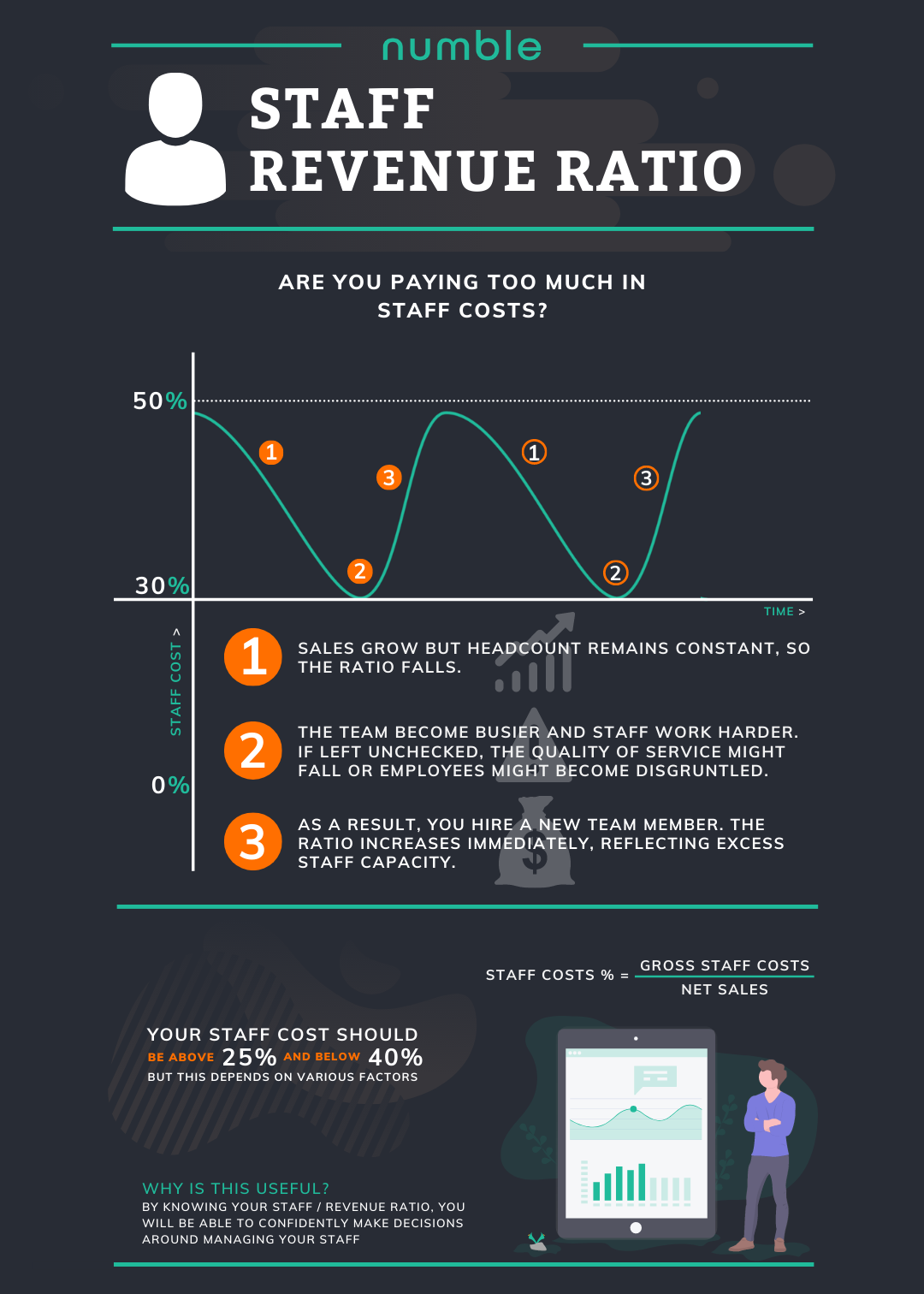

Measuring Staff Costs

Staff-Revenue Ratio

The Formula

Staff Costs % = Gross Staff Costs / Net Sales

Finding the right balance between revenue and staff costs is difficult. Making hiring decisions without useful numbers is even more difficult.

The staff-revenue ratio measures the balance between generating income and compensating your team. It will help you to understand the sweet spot between getting the most from your team without overworking them.

A high ratio is unsustainable. It might imply that you are overworking your staff. And thus compromising the quality of your customer service. Conversely, a low ratio might suggest that your staff are overpaid. Or simply that you have too many employees.

But what is a low or high ratio? Cafes and coffee shops often fluctuate within the 25%-40% range. But in reality this ratio is unique to your business and the type of service you provide. Shop size, quality of service, and location will all determine your optimal ratio. The ratio must calculated over a period of time before you can draw useful conclusions.

You’ll find that the ratio naturally varies over time, for example:

- Sales grow but headcount remains constant, so the ratio falls.

- The team become busier and staff work harder. If left unchecked, the quality of service might fall or employees might become disgruntled.

- As a result, you hire a new team member. The ratio increases immediately, reflecting excess staff capacity.

- The cycle begins all over again.

Of course it's not this simple or clear cut. The ratio is not a magic bullet.

Eventually, you'll get to know your optimal ratio. And monitoring it over time will help you make the right business decisions.