Restaurant and Cafe Accounting: The Definitive Guide (2020/21)

IntroductionRestaurant and Cafe Accounting

In this all-new guide you'll learn the fundamentals of small business accounting for a wide variety of hospitality businesses, including bakeries, caterers, delis and sandwich shops.

Let's begin.

Chapter 1Recording Sales

Recording sales and taking payments is a fundamental part of your operation. Restaurants and cafes are high volume businesses so you need a system that can scale.

Most restaurants and cafes use an app-based Point of Sale (POS) system, which is downloaded onto a tablet or smartphone. Staff record orders on the app.

Staff then take payments on an additional terminal. The POS system is linked to a payment processor that credits the funds to your business bank account.

The POS system also integrates with your accounting system to accurately record revenue and VAT. It should be able to produce useful sales reports to help you monitor your business.

You can also setup your website or an online order platform to take orders and sell products.

ExamplePOS Systems

There are lots of POS systems, but these are the three that our clients use at the moment. They all integrate with accounting systems like Xero, although some integrate better than others. It's difficult to differentiate between POS systems because they all offer an app-based ordering system that pretty much does the same thing. But they do differ on pricing and additional features, so it's worth doing your research.

Good Till

An up and coming iPad based POS till system. Integrates well with Xero and has a useful set of reports.

iZettle

iZettle are the most common POS sytem amongst our clients. They also manufacture their own card readers. The POS system's integration with Xero is not reliable, but the reporting function is comprehensive.

iKentoo

This is a a slightly dated system, but it works well for our one client that uses it. The integration with Xero works well.

ExamplePayment Processors

A payment processor integrates with your POS system to take payments from customer debit and credit cards. Payment processors take a percentage of your sale and credit the remainder to your bank account within a few days.

iZettle

iZettle's POS system came first, but they soon followed up with a payment processing system. They also offer cash advances based on historical order revenue.

Stripe

A huge US tech business with a 'complete' payment platform. Stripe are not the cheapest, but their integrations are usually very good.

ExampleCustom Website Order Platforms

Some cafes and restaurants sell retail products through their online store. But the coronavirus has forced cafes and restaurants to take orders on their website too. It's a great way to serve customers while maintaining social distancing.

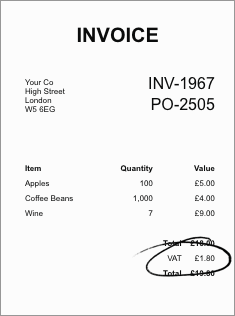

Chapter 2Paying Suppliers

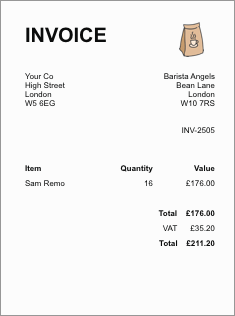

It's easy to be overwhelmed by the sheer volume of invoices that a single restaurant or cafe will receive. It's a good idea to put a simple process in place for monitoring and paying invoices.

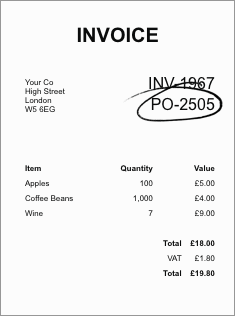

Lots of wholesalers will sell you ingredients and produce on credit. These suppliers will send invoices and statements - in whichever format works for them. It's worth asking to receive invoices digitally.

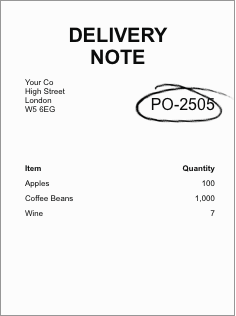

You'll often receive delivery notes with an order.

The delivery note can be matched against the invoice so you know which invoices to pay.

You will have to verify and then settle invoices. And you'll receive a lot of them.

Broadly speaking, there are two ways to manage the process.

Simple approach

Most owner-managed restaurants and cafes manage invoices this way. It's not the most accurate solution, but it's fast and easy to implement.

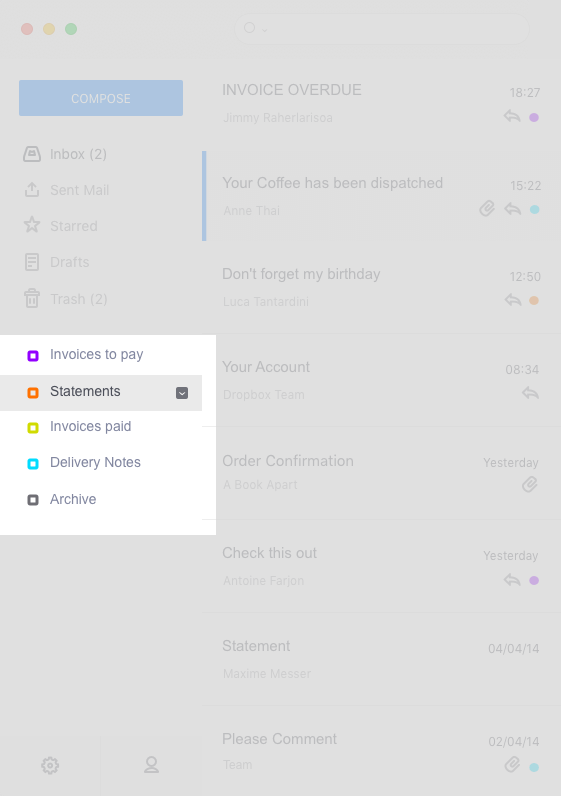

- Save invoices and statements in a separate email folder.

- Every week (or fortnight), look through your email folders and settle any invoices that are due.

- Move paid invoices to a different folder.

Detailed approach

This approach works well for growing businesses, especially when founders want to take a step back from day-to-day bookkeeping. It's scalable and accurate, but it is also more time consuming than the simple approach.

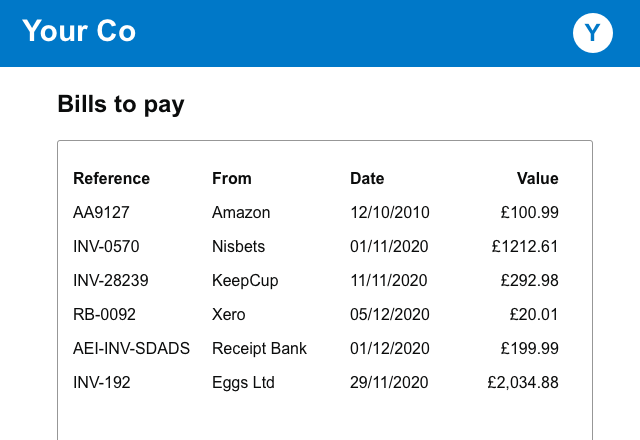

- Record all invoices in your accounting system. An automated invoice scanner like Receipt Bank will help.

- Verify or approve invoices within the system (or make sure only approved invoices are uploaded to the accounting system in step 1).

- Approved invoices are now ready to be paid. You can use the accounting system to indicate when to make payments - ideally on the due date but earlier if you want to foster a better supplier relationship.

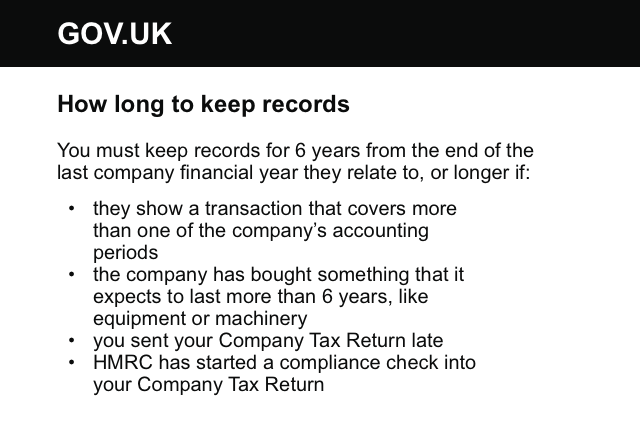

Regardless of which approach you take, HMRC dictate that you'll need to store supplier invoices and receipts for six years. You can store invoices electronically, so there's no need to hold onto original copies.

We recommend Receipt Bank and you can read more about storing receipts here.

Chapter 3Hiring Staff

Building a great team is one of the great challenges of running a highly successful cafe or restaurant. With this comes regular payroll and pension requirements. It's easy to get this wrong so you'll need to be organised.

There are a few things you have to do when you hire staff.

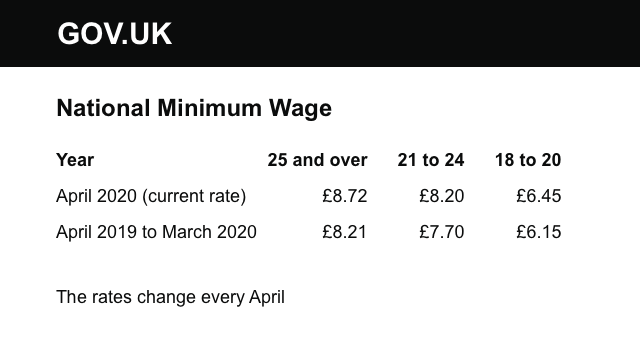

You have to pay employees at least the minimum wage. You'll also to decide what to do with tips and service charge. Consider paying a higher hourly rate instead of sharing out tips individually.

You'll also have to check your employee has the legal right to work in the UK.

Every employer must take out employer's liability insurance. You can be fined £2,500 for every day you are not adequately insured.

Employees must be given a Written Statement of Particulars. Most businesses provide an employment contract. Check out Sparqa Legal for an off-the-shelf contract if you're just getting started.

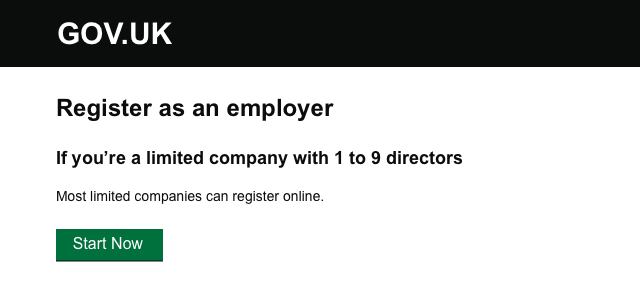

You'll have to register as an employer with HMRC. A payroll system will help to prepare digital submissions which are required. You will also need to set up a pension scheme and enrol your employees. We've listed a few examples below.

How it worksIncome Tax and National Insurance

As an employer, you'll deduct income tax and national insurance from your employee's gross pay. You may also be required to deduct student loan deductions. You will pay all of this to HMRC on their behalf. As an employer, you'll pay employers' national insurance. You will add this to the payment you make to HMRC.

Let's say you agree to pay an employee £2,000 per month. You deduct income tax of £x and employees' national insurance of £x. Your employee receives £x. In this case, employers' national insurance is £x. You pay the combined £x to HMRC the month after payroll.

ExamplePayroll Software

Your accountant will normally choose and operate your payroll system. However, it's not as difficult as it sounds and you can do it yourself.

Xero Payroll

Xero offers an integrated payroll solution if you also use their accounting product. You have to pay a fee based on the number of employees you have. I've used lots of payroll systems over the years and Xero is definitely the most quirky, but they have tried to create a product that works well fot non-accountants. It works ok, so if you already use Xero then it's worth trying.

Quickbooks Payroll

Like Xero, Quickbooks offer an integrated payroll system. I haven't used it myself but it is relatively user-friendly and worth a try if you use Quickbooks.

BrightPay

Our payroll system of choice. It's brilliant if you know what you're doing, but perhaps not suited to non-accountants because it does less hand-holding than Xero and Quickbooks' payroll systems. If you already understand payroll or are willing to learn more, then BrightPay is a great option.

From time to time you'll also hire temporary staff outside of payroll, who you'll pay via invoice like any other supplier. You won't pay income tax and national insurance on their invoices, but the downside is that they aren't your employees.

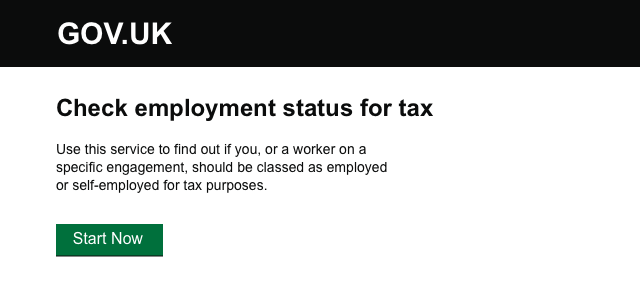

You also have to be careful about falling foul of off-payroll working rules. If your working relationship is deemed by HMRC to be a disguised employment - then you may be liable to operate payroll - incurring payroll taxes in the process. HMRC host a useful tool to check someone's employment status.

ExampleEmployer Pension Schemes

We currently help to administer pension schemes managed by these three providers.

NEST

NEST is definitely the most common scheme. It's free for employers and was set up by the government when they introduced mandatory employer pension schemes. It's ofen implemented badly, but we find it works well when combined with BrightPay.

Aviva Workplace Pensions

Aviva are a huge pension scheme provider. Their auto enrolment pension costs around £30 per month for small employers. But the underlying pension scheme that your employee will receive is likely to be a superior product compared to NEST and other free offerings. The contribution portal is a little tricky though compared to NEST and The People's Pension.

The People's Pension

The People's Pension is a no-frills pension but offers employees a little more than NEST. There is a setup fee of around £300-£500 but ongoing management is free for employers. We reckon it offers the most user friendly pension portal for employers.

Chapter 4VAT

I've known lots of business owners and entrepreneurs who have struggled to get their head around VAT. It's not an easy subject to master and it's worth hiring an accountant if you need to prepare VAT returns.

VAT registered cafes and restaurants must charge VAT on some products. The downside is that your customers cannot claim this back (unless they are also a VAT registered business). The upside of being VAT registered is that a business can reclaim VAT on its purchases. This is particularly valuable if your commercial rent is subject to VAT.

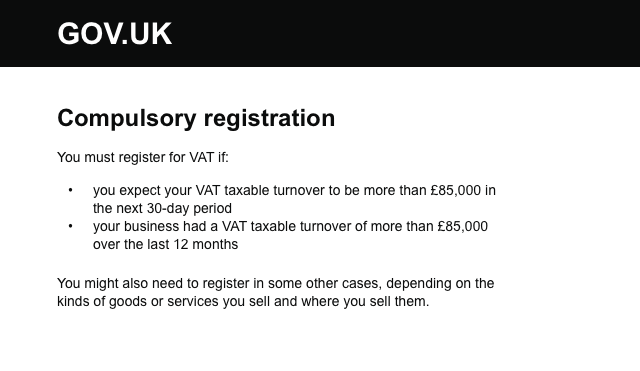

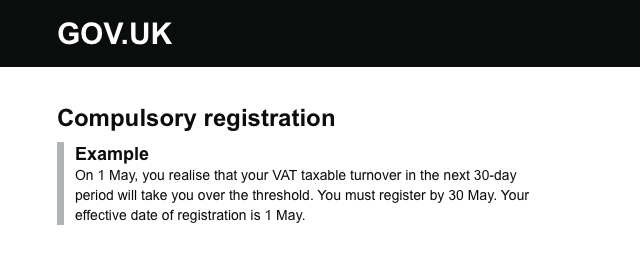

VAT registration is compulsory if your restaurant or cafe revenue exceeds £85,000 over the last 12 months or you expect it to exceed £85,000 in the next 30 days.

If you've gone over the £85,000 threshold over the last 12 months, then you'll need to register within 30 days of the end of the month you went over the threshold. You will need to start charging VAT on first day of the second month after you go over the threshold.

It's unlikely that a restaurant or cafe will meet the other requirement before meeting the 12-month-rule, so we won't dwell on that here.

Sometimes it makes sense to register your business voluntarily. There are usually three good reasons:

1. You only or mostly sell zero-rated products, like coffee beans or bread.

2. Your customers are already registered for VAT. This is unlikely to be the case for restaurants and cafes - most individuals are not registered for VAT. But who knows - maybe you've found a niche catering to business parties.

3. You have huge fit-out costs and need to reclaim VAT now rather than later. This is a valid but short-sighted approach, since you can normally claim VAT on fit-out costs at a later date when you eventually register. But there are a narrow set of circumstances where it might make sense to accelerate this process.

Once you know you need to register, completing the form is really easy (it makes me cringe when I see accountants charging for this).

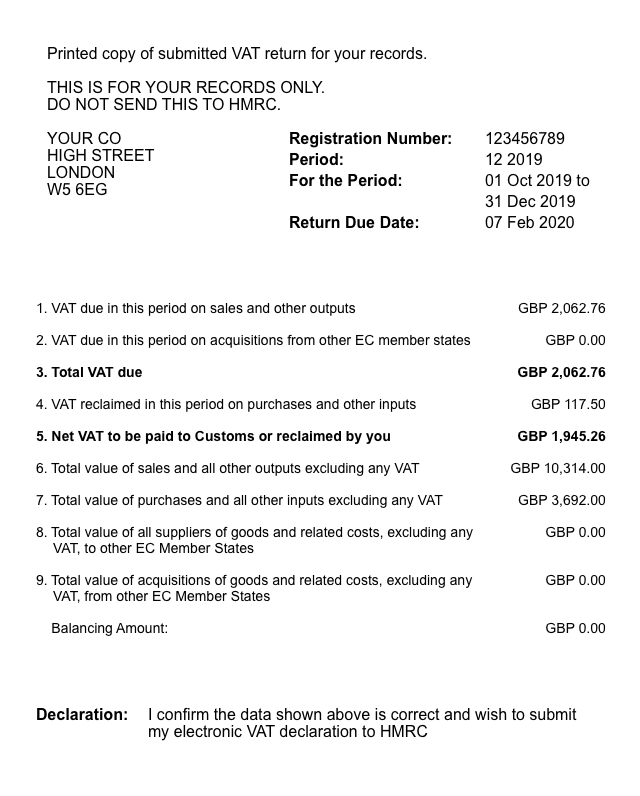

VAT registered cafes and restaurants have to submit VAT returns to HMRC - typically every three months. The return is a summary of the VAT you have charged customers less the VAT you have been charged by suppliers. You will also include the total value of sales and purchases on each VAT return.

Making Tax Digital came into force in April 2019. Since then, businesses over a certain size have had to submit tax returns digitally. Most businesses already submit tax returns digitally - using software like Xero - so I recommend signing up for Making Tax Digital whatever the size of your business.

Reclaiming VAT

A VAT registered business can reclaim VAT on standard-rated purchases with a valid VAT receipt.

From experience, we know that HMRC will not check every single receipt during a VAT inspection but you don't know which ones they will ask for - so do your best to keep them all.

Watch out for VAT you've incurred before registering. You can normally claim VAT on goods purchased in the last four years and services acquired in the last six months.

So don't forget to keep VAT receipts! Store them in Dropbox or another storage system if you aren't yet ready to register for VAT.

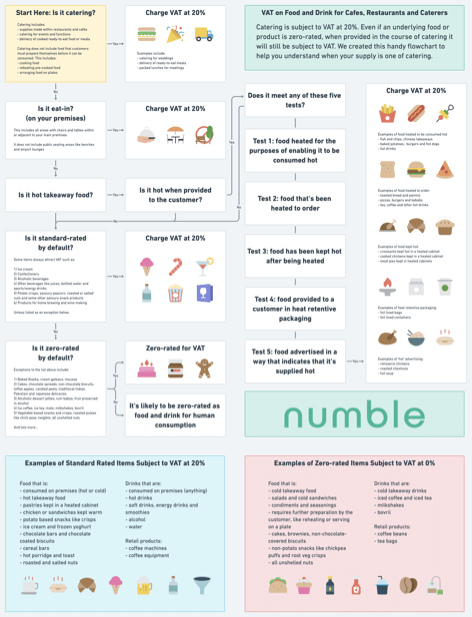

Charging VAT

Determining whether to charge VAT is a complicated topic. You can check out the above flow chart and read more about hospitality VAT here.

Chapter 5Accounting Software

We use and recommend Xero. It works well for our cafe and restaurant clients. We'll also look at other tools and systems that will make your life easier.

ExampleBest Accounting Software for Restaurants and Cafes

In addition to a core accounting system, you'll also need a payroll system as discussed in chapter 3. Receipt scanning is essential for VAT registered cafes and restuarants. Receipt Bank will read most of your receipts and most accountants can sign you up for free. Expense cards like Soldo are useful for going cash-less.

Xero

Our accounting system of choice. It's not without it's flaws, but after more than a decade of experience with lots of accounting systems it's comfortably the best system I have ever used. It's scalable and links up to lots of other tools to make your accounting-life easier.

Quickbooks

Quickbooks and Xero have very similar profiles. We decided early on to specialise in Xero rather than spread out efforts amongst two systems, but we have used Quickbooks and it is a worthy competitor to Xero.

Receipt Bank

Receipt Bank will scan your invoices and receipts, extracting the information you need - like supplier names, dates and values - with a fairly high level of accuracy. It's not perfect but it's a huge improvement over manual data entry.

Soldo

Soldo is one of many expense card solutions. It integrates well with Xero and a number of our clients have found it useful when transitioning to a cash-less operation.

Chapter 6Bookkeeping

If you put rubbish in, you get rubbish out. Bookkeeping has a staid reputation but it's a really important part of business. Accurate and timely bookkeeping is the foundation for useful financial reporting. We've also prepared a template chart of accounts for cafes and restaurants.

When we talk about bookkeeping, we're talking about turning your business data into accounting data. This means turning invoices and receipts into the accounting transactions that underpin your financial reports.

In this section, we'll look at category choice before diving into financial analysis in the next chapter.

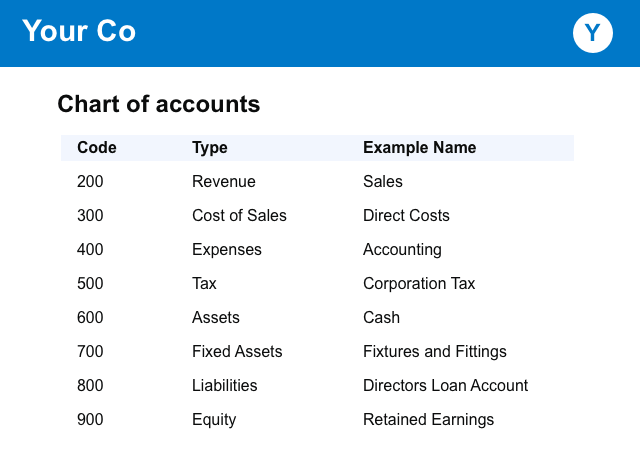

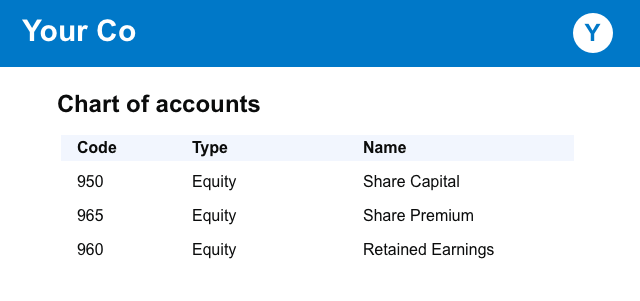

Your accounting data is structured into categories - like "brunch revenue" and "packaging costs". These categories are known as your chart of accounts. They're a bit like the key for a map or the legend for a chart.

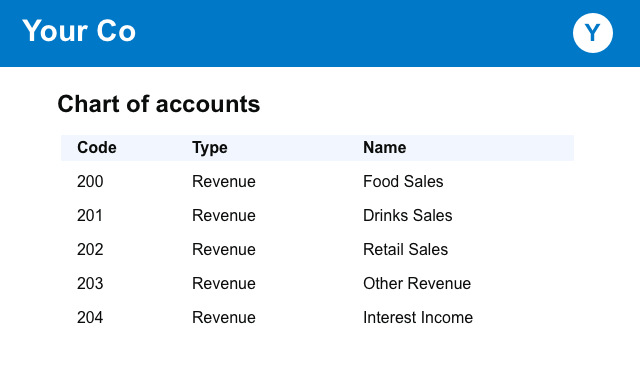

Revenue

Keep the number of revenue categories low to avoid cluttering your accounts. Your POS system is better placed to produce detailed revenue reports. If you try to replicate this detail in your accounts then you'll duplicate your bookkeeping efforts. It's surprisingly easy to mess up accounting data so keep things simple where possible. Even big companies make this mistake all the time.

Expenses

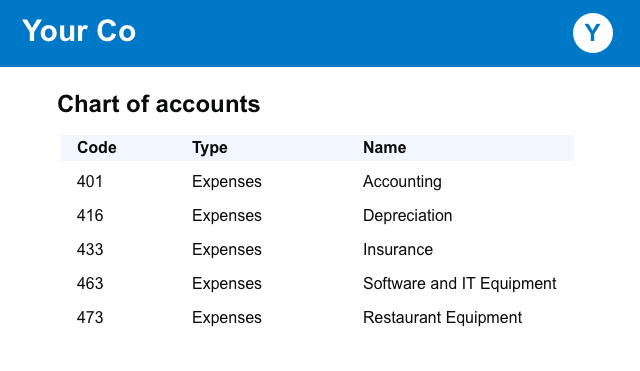

Like with revenue, you should try not to overcomplicate your accounting data by choosing too many categories. However, you do need several cost categories to produce valid statutory accounts, as well as useful expense analysis reports.

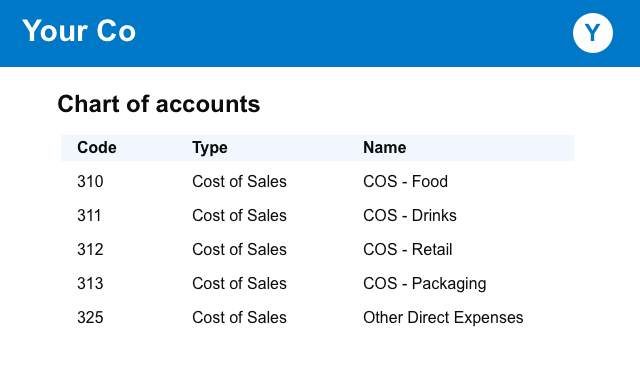

Cost of sales includes the raw materials and consumables that go into selling your product. For restaurants this will be food and drinks. Takeaway businesses should also include packaging.

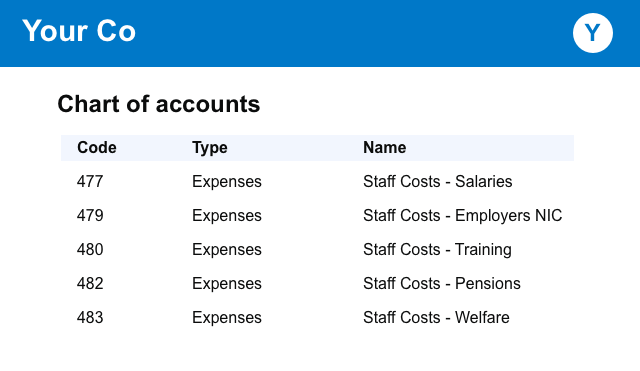

Small businesses should track salaries, taxes, benefits and temporary staff within the staff costs category. Training, staff entertaining and recruitment costs also come under this section.

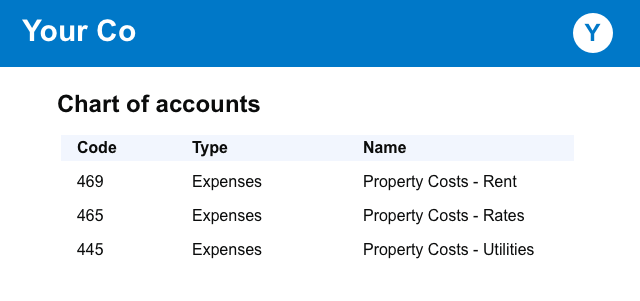

Property costs are usually fixed. It's worth segregating rent and rates from other business costs that need your attention.

All other business costs are generally grouped into one large category called other administrative expenses or operating expenses. For this reason it often becomes a dumping ground for all sorts of costs.

To avoid this problem, it sometimes makes sense to split operating expenses into variable and fixed costs. Variable costs can creep up slowly so are worth monitoring carefully. Like an unused gym subscription, many businesses pay for subscriptions they never use.

Balance Sheet

Over the years I've noticed that few business owners truly grasp the concept of the balance sheet. Most do not understand it at all when they get started. But you'll eventually come to understand how it works.

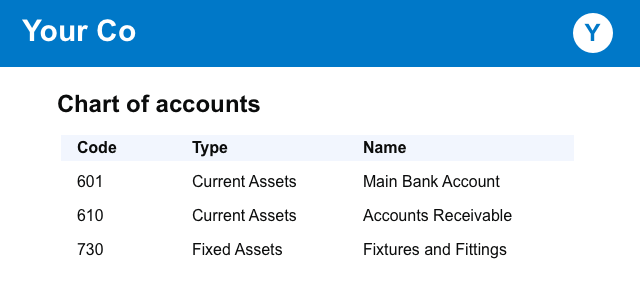

Positive things flow from assets. Cash is an asset, and most assets are either purchased for cash - like fixed assets - or convert into cash - like money-owed-by-customers, which goes by the names trade debtors or accounts receivable.

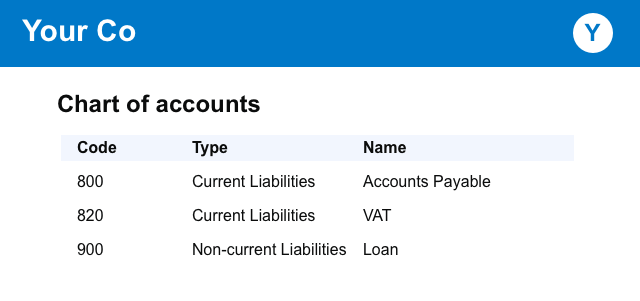

Taxes, loans, and money owed to suppliers are all liabilities on your balance sheet.

Finally, equity incorporates the company's share capital and historical earnings. At each year end, the balance on the company's profit and loss is rolled up into one number and locked away in the company's retained earnings category. Declaring dividends reduces the retained earnings balance.

The final retained earnings entry on the balance sheet usually equals cumulative profits less cumulative dividends.

Bank Reconciliations

Once you've chosen the best chart of accounts structure for your accounts, it's now on you to record your future accounting data using these categories.

This is bookkeeping. This is the bit that owners often do badly. Do it regularly (or ask your accountant to do it regularly) to minimise surprises and headaches.

Chapter 7Financial Reporting

Few founders enjoy the financial side of running a business. It can be pretty overwhelming. Rather than trying to analyse everything, I suggest prioritising a few important financial targets.

When I first meet a business owner I like to ask, "What do you want from your business?"

Your answer is incredibly important and also incredibly personal. It's your business - and your life - and you decide what you want out of it.

It's really easy to chase revenue growth or headcount growth because that seems to be the whole point of business (anyone for world domination?) As a result, most people assume that business analysis is all about making profit.

But it's not.

First, you figure out what you want from your business. Then you decide what goals to shoot for. Then you build financial reports to achieve those goals.

With that in mind, what do you want from your business?

There is no right answer. Let's look at a few potential responses.

1) I want to build a big restaurant chain, sell it, then retire early.

2) I want to build a cafe where I get to know my regulars and enjoy great coffee. Maybe I'll open a second cafe eventually, but for me quality and a great vibe are the most important thing.

3) I want to make a lot of money. I'm happy to work hard, but I want to generate real income that I can spend on myself and my family.

Most people's goals fall within the scope of these three answers. Life isn't totally binary, so your real answer will blur the lines between some or all of these options.

It will almost certainly change over time.

With your personal answer in mind, work backwards to figure out which financial goals and non-financial goals are most appropriate.

Setting The Right Goals

If you goal is to make money now, then you should prioritise profit or cash flow.

This doesn't necessarily mean you should prioritise revenue growth. Lots of small businesses generate healthy profits and lots of large conglomerates don't make any money at all.

Put in place an accounting structure that measures profit and cash flow. Figure out which aspects of business are the most profitable. You'll discover that some products are more profitable than others (and it's not always the ones you expect).

How can you sell more of your most profitable products?

Profit First by Mike Michalowicz provides a useful framework for focusing on profit.

If you goal is to build a great independent coffee shop with loyal customers, then maybe the numbers you should track aren't financial at all. Consider paying more attention to your reviews. Get feedback from your ideal customers. Adjust your formula and see how feedback changes.

And finally, if you're looking for overall growth then you will probably need a healthy marketing budget. Look for ways to reduce spend across the business - perhaps by tweaking suppliers or reducing staff costs - so you can spend more on marketing. (This isn't the only approach - there are millions of ways to grow a business).

Your business and your situation are unique. Be honest about your goals, be open to how you might achieve them, and be creative in finding the right way for you.

The Rule of Three

When it come to the big goals, keep it simple. Monitor no more than three goals. Any more and you'll lose track.

Despite the variety I've been droning on about, I'd like to share two common types of financial analysis that are likely to be useful for most cafes and restaurants.

Staff Costs / Revenue is a ratio that defines the relationship between the amount you spend on your team and the amount of money you make. The actual figure will vary between different businesses. What's important is how the ratio changes over time for your business. It may tell you when you're overworking staff (if the ratio falls) or when you're team is bigger than you need (if the ratio increases). The figure will probably not come as a surprise, but it will give you financial evidence to make decisions based on what you experience first hand in the business.

It's also worth preparing a profit margin report. Again, it will vary between different businesses, so it's not always useful for comparing one cafe to another. But it's useful for tracking your own metrics over time, and will likely highlight problems like creeping costs or supplier price rises. By measuring these regularly, you'll be in a better position to make decisions before they become a problem.

Chapter 8Additional Reading

I've worked with small businesses including multiple cafes, restaurants and bakeries for over a decade. Here's a few books I've found useful (some of which were recommended to me by business owners).