Getting Started With HMRC for Limited Companies

Authorising Your Accountant To Deal With HMRC

When you sign up with Numble, we will request authorisation to discuss your tax affairs with HMRC.

We can actually file most taxes without HMRC authorisation. But authorisation makes our job much easier.

Here's how it done.

How Do I Grant 64-8 Agent Authorisation Online?

The old method is to complete form 64-8 to authorise your accountant for one or several taxes.

But you will need to print and post the form to HMRC. So it's often easier to authorise your accountant on your HMRC Online Services account.

How Do I Grant HMRC Online Access To My Accountant?

The easiest way to authorise your agent is on HMRC Online Services, using your Government Gateway account:

- Login here

- Select Manage Account (top bar)

- Select Add, view or change tax agents

- Select Manage Agents

- Select Add an agent (if you have an agent, you'll need to remove them first

- Enter your agent's ID - ThisIsAFakeID-1 2345678910

Repeat for all taxes for which you would like to grant access. It is possible to have several Government Gateway accounts.

How Do I Create A New User For HMRC Online Services?

This step is not always required. Check with us first.

You can create a new user and grant them access to your HMRC Online Services account:

- Login here

- Manage Account (top bar)

- Select Add or delete a team member

- Select Add a team member

- Enter their full name, email address and choose their role

- Select Continue

Before giving access to your online account, bear in mind that an agent will be able to do almost anything that you can do. So be careful who you grant access to your account.

We sometimes obtain this level of access. It allows us to setup additional taxes in the account on your behalf, and update some information that cannot be corrected with regular agent authorisation.

If you don't have an HMRC Online Services account, you can create one.

Why Should I Setup HMRC Online Services?

An online HMRC account is the easiest way to view your current tax balance and settle your tax bill.

Set a reminder to check your account every month because errors happen.

How Do I Setup HMRC Online Services?

First you'll need a Government Gateway account which you can setup online.

Next, you'll attach each of your taxes to the account. Each account may link to several business taxes or personal taxes. A typical business account will have access to Corporation Tax, PAYE and VAT.

To add a tax login to your HMRC Online Services account and select Add a tax to your account to get online access to a tax, duty or scheme.

Corporation Tax

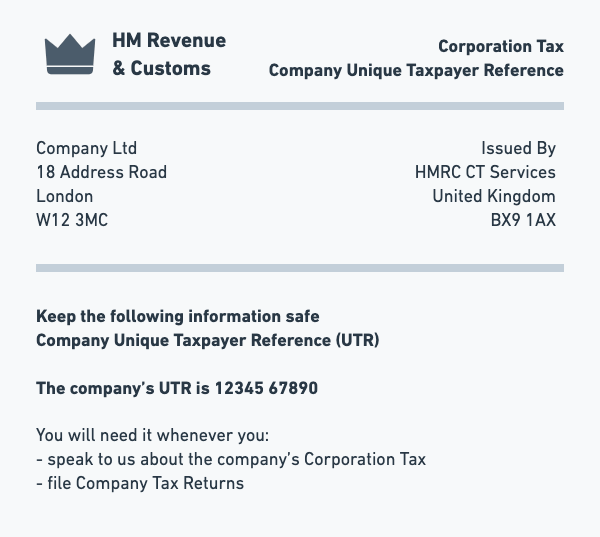

To add corporation tax to your HMRC account, you'll need to know your Company Unique Tax Reference (UTR). You will receive the UTR in the post when you setup your limited company and you may also receive a CT600 letter (notification to file a tax return).

PAYE (Pay As You Earn, Payroll Tax)

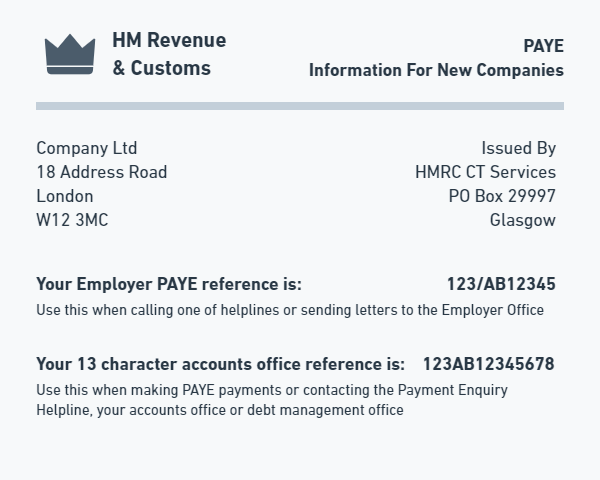

To add PAYE to your HMRC account, you will need to enter your Accounts Office Reference and Employer PAYE Reference.

You will receive these when you register for payroll.

If you only have one code and not the other, you can request this by contacting HMRC. They should be able to tell you the other code on the phone or on webchat.

If you do not have your Employre PAYE Reference or your Accounts Office Reference, then you should also contact HMRC. They might have to post the codes to your registered office address.

VAT

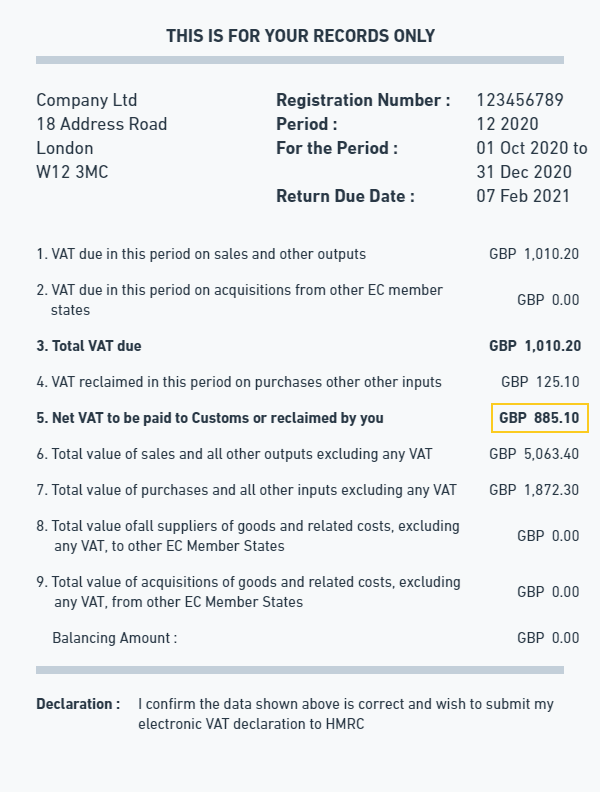

To add VAT to your HMRC account, you'll need to know:

- Your VAT number

- Your VAT registration date

- Where your business is registered for VAT

You can find this information on your VAT registration certificate.

You may also need:

- The Box 5 figure from any one of your last three VAT returns.

Self Assessment Tax

You will normally create a government gateway account or personal tax account when registering for self assessment tax.

However, if for some reason you need to add self assessment tax to an existing account, you will need to know your:

- Personal Unique Tax Refererence (UTR)

- National Insurance Number